Economics of PPC Pricing: Why Profit Sharing is the Future

23 February 2010In this third post in the Economics of PPC Pricing series, we consider the profit sharing model (you might also like to refer back to the previous Economics of PPC pricing posts on the markup model and the cost-per-sale model). By looking at the cost and revenue structures for both client and PPC agency, we discover that under the profit sharing model client and agency motivations are perfectly aligned, making profit sharing a highly efficient method of PPC compensation.

Although we infer that profit sharing is sound from an economic sense, we find it does have problems of its own in terms of implementation and conversion attribution, and conclude that profit sharing should only be considered once a strong and tested relationship has already been established between client and agency.

So let’s get started.

With a profit share deal, instead of paying the client paying the agency a percentage of PPC spend fee, or a set fee for each sale, the PPC agency receives a share of all profits they help to deliver for the client through PPC activity.

If the PPC agency helps make the client $50,000 in profit from PPC, and the agreed profit share percentage is 10%, the client will pay the PPC agency $5,000 for their troubles.

Since the more profit the agency makes for the client, the higher their fees, it is therefore in the agency’s best interests to make the client as much profit as possible. Unlike the percentage of spend (markup) model, there is no monetary incentive for the agency to spend money haphazardly on clicks to increase their commission. With a profit share model, it’s the other way around. There is an incentive for the PPC agency to reduce wastage and increase spend in areas which generate a return.

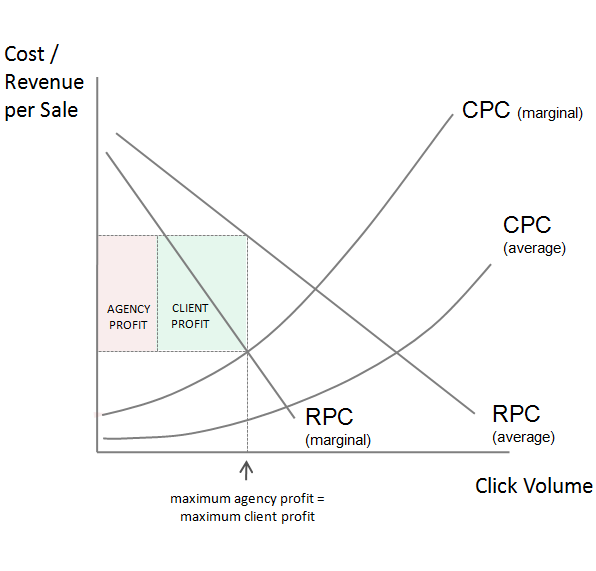

The profit share model is the only PPC pricing model which is perfectly efficient from an economics point of view. Unlike the management fee model, the percentage of spend model and the cost-per-sale model, with a profit share model both client and agency have the same common goal: to maximise client profit. As pointed out by Andreas Reiffen in his analysis on paid search profit sharing, it allows a win-win situation in which both the client and PPC agency are better off.

So the profit share model is economically sound. The point of maximum agency profit is also the point of maximum client profit. There is no other click volume which will deliver a higher profit. It provides the necessary incentives to help both client and agency maximise their bottom line.

What’s more, since a common goal is being chased by both parties, the profit share model provides a solid foundation for a long-lasting, open relationship between client and agency. It creates a platform for innovation, makes testing worthwhile and encourages the sharing of ideas to reduce clicks costs and increase click revenue. It’s in the agency’s interest to make recommendations to improve website conversion rates; and it’s in the client’s interest to share knowledge of their business with the agency to improve keyword targeting and ad copy. It’s a mutually beneficial agreement that can’t go wrong.

Or can it?

Perhaps. A client’s profit figures are sensitive information. If leaked into the hands of competitors, it could be disastrous for the client. A significant level of trust between both parties is therefore required for a profit sharing model to work.

Conversion Attribution

There’s also the issue of conversion attribution. Since the PPC agency’s fees are bases on profit generated from PPC activity only, how much the agency receives is entirely based on tracking capabilities.

Tracking generally uses cookies to measure customers who buy online within a certain time period (say 30 days), and generally ignores revenue through offline methods such as phone calls and store walk-ins. If someone clicks on a PPC ad while at work, then makes an order when at home on a different computer, or perhaps picks up the phone, that revenue is not attributed to PPC. Nor is revenue from users who have high browser privacy settings or reject cookies.

As pointed out by Econsultancy, PPC marketers are currently missing out on credit for half of the revenue their campaigns are driving, which is a huge amount. With a profit share model, agency fees are based entirely on trackable revenue, so the agency will be under-rewarded for the value they deliver. This can significantly compromise the level of investment in the client’s PPC campaigns, and the level of testing and innovation.

This bias in conversion attribution can also lead to the PPC agency reducing bids on generic ‘research’ keywords from customers earlier in the buying cycle. These keywords might not convert profitably online (according to the under-reported tracking), but may be essential for the client’s walk-in orders, branding or long-term growth. Again – not very efficient.

So although the profit share model performs exceptionally well at aligning the motivations of client and agency, it is far from a perfect PPC pricing model. A high level of trust is essential for it to work – as is accurate (and fair) revenue tracking. Until conversion attribution improves considerably, any business with strong brand or numerous different marketing touch points should use the profit share model with caution.

Are you a fan of the profit share model? Have you made it work for both client and agency? Or is it one for the future when conversion attribution improves? Share your thoughts in the comments section below.

12 thoughts on “Economics of PPC Pricing: Why Profit Sharing is the Future”